Married couples could save up to 30000. Deposits into a first-time.

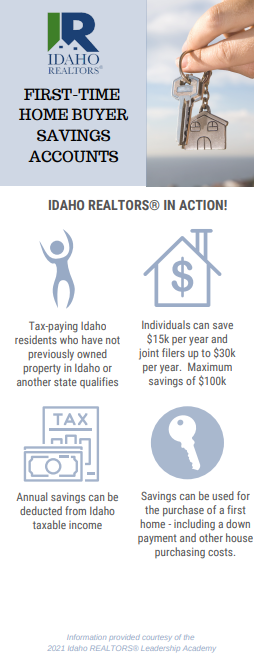

First Time Home Buyer Savings Accounts Idaho Realtors

Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income tax return.

. A first-time home buyer. In fact most of your low to zero down payment options. Ad Manage Your Money Easily With One Of Our Savings Account Options.

Individuals may deduct up to 15000 each year. Deduction for first-time home buyers. Does it directly or indirectly create or increase any taxes fees or other assessments.

A Account holder means an individual who resides in Idaho who has filed an income tax return in Idaho for the most recent taxable year who is a first-time home buyer and who establishes individually or jointly a first-time home buyer savings account. Young members with this account will earn a special dividend rate until age 26 and account owners who are age 18 and under can learn about saving with the interactive Rise App in CapEd eBanking. A Account holder means an individual who resides in Idaho who has filed an income tax return in Idaho for the most recent taxable year who is a first-time home buyer and who establishes individually or jointly a first-time home buyer savings account.

Ad Beautifully presented new builds for sale at all price points across the UK. Set up an instant alert for new properties and discover your future home today. Idahos First-Time Home Buyer Savings Account 100 minimum to open 2 4 5.

1 As used in this section. HB 589 would allow individuals to save up to 15000 per year tax-free to put toward the cost of purchasing a home in Idaho. First-time home buyers who establish a First-time Home Buyer Savings Account can deduct their account contributions and interest earned from Idaho taxable income.

The Idaho State Tax Commission will be the overseeing entity concerning the rules and forms of this new account. 41 rows The Idaho First-Time Home Buyer Savings helps you save for your first place to call home and is supported by the State of Idaho. Like many states Idaho offers a mortgage credit certificate MCC to first-time homebuyers that allows you to claim a federal tax credit up to 35.

That was an increase of 15 yearoveryear according to. Ad Beautifully presented new builds for sale at all price points across the UK. First Time Home Buyer Savings Accounts Idaho Realtors Share this post.

Rather than the typical 5 down payment requirement there are options with down payments as low as 0 down if you are eligible. Contributions to the account earn interest 1 and may be eligible for a State of Idaho tax deduction 2. Individuals may deduct up to 15000 each year.

Married couples filing a joint tax return can deduct up to 30000 a year. The money set aside in these tax-advantaged accounts can be put towards the down payment and closing costs associated with buying your first home. Rise Youth and Young Adult Savings Account.

The Idaho First-Time Homebuyer Savings Account helps you save for that first place to call home and is supported by the State of Idaho. Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income. Set up an instant alert for new properties and discover your future home today.

In this instance the term First-time home buyers references buyers who have never owned or purchased a home in the state of Idaho. Find Out More Online. Learn about a cool new program to help you get there.

You will have to pay a 300 fee to your borrower but thats a small price to pay compared to the long. In need of some additional help. From Cash ISAs And Fixed Rate Bonds To Instant Access Savings Accounts.

An Idaho First-Time Home Buyer Savings Account allows you to save for down payment and closing costs if you qualify for a first-time home purchase while reducing the amount of Idaho income tax you owe. First-time home buyers who establish a First-time Home Buyer Savings Account can deduct their account contributions and interest earned from Idaho taxable income. Idaho first time home buyers can get 500 to 8000 down payment assistance.

Savings can be used for a down payment and associated costs. Bank Has Loan Officers To Personally Guide First Home Buyers Through the Process. Are you a first-time home buyer thats looking to buy in the next couple of years.

Individuals may deduct up to 15000 each year. We also have several loan options with down payment assistance. Idaho Code section 63-3022V.

Check out these awesome tips for budgeting to help you get into your dream. Married couples filing a joint tax return can deduct up to 30000 a year. That was an increase of 15 yearoveryear according to.

Idaho residents who set up a First-Time Home Buyer Savings Account may claim an income tax deduction on their account contributions and interest earned starting with their Idaho income tax return. We specialize in First time home buyer programs that help you purchase your first Idaho home. The Rise Youth and Young Adult Savings account is created specifically for youth ages 0 through 25 years.

In todays video I. First-time homebuyers living in the state of Idaho have a number of mortgage options available when they start shopping for loans such as FHA USDA. House Bill 589 First-time home buyer savings account.

Contributions to the account earn interest and may be eligible for a State of Idaho tax deduction. Idaho Central Credit Union offers a variety of products well suited for the first-time homebuyer. The money saved can be deducted.

View the Savings Accounts That Have the Highest Interest Rates in 2022. The amount borrowed is forgiven in tiers.

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

Have You Heard About Idaho S New First Time Home Buyer Savings Account Boise Regional Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

First Time Home Buyer Savings Accounts Idaho Realtors

Idaho First Time Home Buyer Savings Account Lookout Credit Union

0 comments

Post a Comment